Mortgage Loan Officer Salary

Average by State

Are you thinking about starting your career as a Mortgage Loan Officer (MLO)?

The first thing you should know is that this isn’t a job where you’ll just be crunching numbers or licking envelopes. You’ll also get to collaborate with tons of new people every day and make important financial decisions.

In this article, we walk you through the salary and commission structure for a junior, intermediate and senior-level MLO in each of the 50 states.

Bonus: We also share a few tips on how you can boost your salary as a loan officer and enjoy a very prolific career.

Let’s get started!

Chapters

chapter 1:

Loan Officer Responsibilities

A Mortgage Loan Originator could pertain to either an individual or an institution. In the case of the latter, this is usually a bank or some other type of financial lending institution.

The loan officer walks borrowers through the process of getting their loan application approved. An MLO, in particular, helps borrowers procure the financing they need to buy a house.

Given that this is a big life decision for the borrower, an MLO does so much more than simply represent the institution in selling loan products. They take on the job of being a confidante and adviser in whose guidance the borrower places their full trust.

What is a Mortgage Loan Officer’s Job Description?

A day in the life of an MLO looks something like this:

- Interviewing loan applicants and walking them through the terms and conditions of the loan

- Assessing borrowers’ needs while taking into consideration their income, assets and credit to assess their creditworthiness

- Collecting borrowers’ documentation like an appraisal report, credit report and reference check

- Guiding them through the paperwork and preparing loan documents in compliance with industry standards

- Facilitating the closing between the buyer, seller, real estate agent, escrow officer, etc.

- Resolving issues in a timely manner

Because this job has a high satisfaction rate, Best Business Jobs ranks this profession at #8 in 2021, based on a range of factors like salary, future growth, job stress and work-life balance, to name a few.

The professional life of an MLO is pretty rewarding. You’ll see a lot of interesting challenges come your way. As an MLO, you’ll enter the borrower’s life at one of their biggest moments, and expertly guide them through it.

chapter 2:

Loan Officer Salary Structure & Benefits

An MLO working for a larger institution, like a bank for example, is more likely to receive a salary, commission and benefits. They have access to a ready stream of client walk-ins and prospect phone calls.

On the flip side, a small state-licensed mortgage broker may have to solely rely on commissions for their income.

At times, your commission may even be dependent on a monthly quota, i.e. if you close “X” value in loans every month, you’ll get paid a big commission. If you fall short of that goal, you may just receive a fixed minimum dollar amount for each loan.

Let’s talk numbers!

We’ll break this down by salary, commission and also map out the most common benefits that MLOs receive.

MLO Base Salary (Nationwide Average)

We’ve collected a few base salary statistics from a couple of different sources. These vary a lot based on your city, experience, skill-set, education and certifications.

Salary.com estimates that as of April 2021, the average salary for a loan officer in the U.S. typically ranges between $33,237 and $53,931.

Indeed paints a different picture. Based on aggregate salaries from over 10,000 candidates, Indeed found that the annual base salary for an MLO is $234,277.

Mapping this out to experience, that would translate as such:

- 1 to 5 years – $199,395

- 6 to 9 years – $312,515

- Over 10 years – $343,253

ZipRecruiter chimes in with different numbers. The median annual salary as per their calculations is $74,838 or $36 per hour.

To get an idea of the delineation by seniority, Career Explorer reveals some interesting insights.

- Senior Loan Officers – $111,888 per year

- Intermediate Loan Officers – $57,580 per year

- Junior Loan Officers – $29,632 per year

MLO Commission (Nationwide Average)

The commission structure of an MLO varies quite a bit from one institution to the next based on the fee split, salary and other benefits and bonuses.

Indeed estimates that this tallies to about $27,600 per year based on information collected from past and present employees.

MLO Benefits (Nationwide Average)

Indeed has listed the most common benefits of an MLO as such:

- 401(k)

- 401(k) matching

- Vision insurance

- Dental insurance

- Health insurance

- Life insurance

- Work from home

As stated before, it doesn’t make sense to hang your hat on these numbers as they’re only meant to give you an initial idea of the compensation.

Your actual pay will be totally dependent on the state in which you operate, the company at which you work, and your specific experience and skill-set.

Stick around. Below, we’ll go over the salary structure by state.

chapter 3:

Average Loan Officer Salary By State

Now that you’ve set your mind on this fulfilling career, let’s talk about how much you can make.

Here, we’ll look at the salary in each state, territory and district, bifurcated by junior, intermediate and senior-level MLOs. These numbers were taken from Career Explorer.

As far as experience is concerned, senior Mortgage Loan Originators have over 10 years of experience, mid-level MLOs have anywhere from 6 to 9 years, and junior-level loan officers have generally worked for about 1 to 5 years.

Choose Your State Below:

Click your state on the interactive map to view your state’s average loan officer salary.

Top 10 states with the highest pay for loan officers

If you are looking for the highest paid state to enter your career as a loan officer these are the top 10 states according to Career Explorer.

- 1. Connecticut

Entry-level Annual Salary: $88,768 - 2. Illinois

Entry-level Annual Salary: $81,620 - 3. New York

Entry-level Annual Salary: $78,520 - 4. New Hampshire

Entry-level Annual Salary: $76,430 - 5. Nebraska

Entry-level Annual Salary: $75,800 - 6. Kansas

Entry-level Annual Salary: $75,462 - 7. Washington DC

Entry-level Annual Salary: $74,840 - 8. New Jersey

Entry-level Annual Salary: $73,180 - 9. Minnesota

Entry-level Annual Salary: $72,030 - 10. Massachusetts

Entry-level Annual Salary: $70,090

Alabama

Loan officer salaries in Alabama were found to be 8% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $92,867

Hourly: $44.65

Intermediate Mortgage Loan Officer salary

Annual: $53,488

Hourly: $25.72

Junior Mortgage Loan Officer salary

Annual: $30,807

Hourly: $14.81

Alaska

Loan officer salaries in Alaska were found to be 14% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $115,706

Hourly: $55.63

Intermediate Mortgage Loan Officer salary

Annual: $56,980

Hourly: $27.39

Junior Mortgage Loan Officer salary

Annual: $28,060

Hourly: $13.49

Arizona

Loan officer salaries in Arizona were found to be 3% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $122,349

Hourly: $58.82

Intermediate Mortgage Loan Officer salary

Annual: $52,696

Hourly: $25.33

Junior Mortgage Loan Officer salary

Annual: $22,696

Hourly: $10.91

Arkansas

Loan officer salaries in Arkansas were found to be 7% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $105,964

Hourly: $50.94

Intermediate Mortgage Loan Officer salary

Annual: $55,514

Hourly: $26.69

Junior Mortgage Loan Officer salary

Annual: $29,083

Hourly: $13.98

California

Loan officer salaries in California were found to be 0% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $137,657

Hourly: $66.18

Intermediate Mortgage Loan Officer salary

Annual: $60,420

Hourly: $29.05

Junior Mortgage Loan Officer salary

Annual: $26,519

Hourly: $12.75

Colorado

Loan officer salaries in Colorado were found to be 1% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $119,930

Hourly: $57.66

Intermediate Mortgage Loan Officer salary

Annual: $61,010

Hourly: $29.33

Junior Mortgage Loan Officer salary

Annual: $27,320

Hourly: $13.13

Connecticut

Loan officer salaries in Connecticut were found to be 39% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $196,494

Hourly: $94.47

Intermediate Mortgage Loan Officer salary

Annual: $88,768

Hourly: $42.68

Junior Mortgage Loan Officer salary

Annual: $40,102

Hourly: $19.28

Delaware

Loan officer salaries in Delaware were found to be 3% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $121,030

Hourly: $58.19

Intermediate Mortgage Loan Officer salary

Annual: $60,140

Hourly: $28.92

Junior Mortgage Loan Officer salary

Annual: $35,840

Hourly: $17.23

District of Columbia (Washington DC)

Loan officer salaries in the District of Columbia were found to be 10% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $178,220

Hourly: $85.68

Intermediate Mortgage Loan Officer salary

Annual: $74,840

Hourly: $35.98

Junior Mortgage Loan Officer salary

Annual: $45,980

Hourly: $22.11

Florida

Loan officer salaries in Florida were found to be 22% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $134,700

Hourly: $64.76

Intermediate Mortgage Loan Officer salary

Annual: $67,760

Hourly: $32.58

Junior Mortgage Loan Officer salary

Annual: $35,580

Hourly: $17.10

Georgia

Loan officer salaries in Georgia were found to be 14% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $131,410

Hourly: $63.18

Intermediate Mortgage Loan Officer salary

Annual: $54,690

Hourly: $26.29

Junior Mortgage Loan Officer salary

Annual: $28,970

Hourly: $13.93

Hawaii

Loan officer salaries in Hawaii were found to be 15% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $153,563

Hourly: $73.83

Intermediate Mortgage Loan Officer salary

Annual: $66,666

Hourly: $32.05

Junior Mortgage Loan Officer salary

Annual: $28,941

Hourly: $13.91

Idaho

Loan officer salaries in Idaho were found to be 9% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $122,022

Hourly: $58.66

Intermediate Mortgage Loan Officer salary

Annual: $59,677

Hourly: $28.69

Junior Mortgage Loan Officer salary

Annual: $29,186

Hourly: $14.03

Illinois

Loan officer salaries in Illinois were found to be 50% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $196,688

Hourly: $94.56

Intermediate Mortgage Loan Officer salary

Annual: $81,620

Hourly: $39.24

Junior Mortgage Loan Officer salary

Annual: $33,870

Hourly: $16.28

Indiana

Loan officer salaries in Indiana were found to be 4% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $116,587

Hourly: $56.05

Intermediate Mortgage Loan Officer salary

Annual: $57,023

Hourly: $27.41

Junior Mortgage Loan Officer salary

Annual: $27,890

Hourly: $13.41

Iowa

Loan officer salaries in Iowa were found to be 4% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $112,240

Hourly: $53.96

Intermediate Mortgage Loan Officer salary

Annual: $61,518

Hourly: $29.58

Junior Mortgage Loan Officer salary

Annual: $33,717

Hourly: $16.21

Kansas

Loan officer salaries in Kansas were found to be 43% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $167,578

Hourly: $80.57

Intermediate Mortgage Loan Officer salary

Annual: $75,462

Hourly: $36.28

Junior Mortgage Loan Officer salary

Annual: $33,981

Hourly: $16.34

Kentucky

Loan officer salaries in Kentucky were found to be 25% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $135,201

Hourly: $65.00

Intermediate Mortgage Loan Officer salary

Annual: $67,450

Hourly: $32.43

Junior Mortgage Loan Officer salary

Annual: $33,650

Hourly: $16.18

Louisiana

Loan officer salaries in Louisiana were found to be 8% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $95,370

Hourly: $45.85

Intermediate Mortgage Loan Officer salary

Annual: $48,230

Hourly: $23.19

Junior Mortgage Loan Officer salary

Annual: $28,030

Hourly: $13.48

Maine

Loan officer salaries in Maine were found to be 17% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $123,050

Hourly: $59.16

Intermediate Mortgage Loan Officer salary

Annual: $64,110

Hourly: $30.82

Junior Mortgage Loan Officer salary

Annual: $36,770

Hourly: $17.68

Maryland

Loan officer salaries in Maryland were found to be 13% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $150,990

Hourly: $72.59

Intermediate Mortgage Loan Officer salary

Annual: $68,060

Hourly: $32.72

Junior Mortgage Loan Officer salary

Annual: $29,220

Hourly: $14.05

Massachusetts

Loan officer salaries in Massachusetts were found to be 26% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $185,400

Hourly: $89.14

Intermediate Mortgage Loan Officer salary

Annual: $70,090

Hourly: $33.70

Junior Mortgage Loan Officer salary

Annual: $37,330

Hourly: $17.95

Michigan

Loan officer salaries in Michigan were found to be 13% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $159,622

Hourly: $76.74

Intermediate Mortgage Loan Officer salary

Annual: $63,657

Hourly: $30.60

Junior Mortgage Loan Officer salary

Annual: $14,110

Hourly: $6.78

Minnesota

Loan officer salaries in Minnesota were found to be 13% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $127,050

Hourly: $61.08

Intermediate Mortgage Loan Officer salary

Annual: $72,030

Hourly: $34.63

Junior Mortgage Loan Officer salary

Annual: $42,240

Hourly: $20.31

Mississippi

Loan officer salaries in Mississippi were found to be 10% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $110,860

Hourly: $53.30

Intermediate Mortgage Loan Officer salary

Annual: $57,500

Hourly: $27.64

Junior Mortgage Loan Officer salary

Annual: $32,160

Hourly: $15.46

Missouri

Loan officer salaries in Missouri were found to be 19% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $123,540

Hourly: $59.40

Intermediate Mortgage Loan Officer salary

Annual: $68,010

Hourly: $32.70

Junior Mortgage Loan Officer salary

Annual: $41,200

Hourly: $19.81

Montana

Loan officer salaries in Montana were found to be 2% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $100,700

Hourly: $48.41

Intermediate Mortgage Loan Officer salary

Annual: $57,840

Hourly: $27.81

Junior Mortgage Loan Officer salary

Annual: $33,910

Hourly: $16.30

Nebraska

Loan officer salaries in Nebraska were found to be 27% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $134,840

Hourly: $64.83

Intermediate Mortgage Loan Officer salary

Annual: $75,800

Hourly: $36.44

Junior Mortgage Loan Officer salary

Annual: $37,190

Hourly: $17.88

Nevada

Loan officer salaries in Nevada were found to be 18% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $156,010

Hourly: $75.00

Intermediate Mortgage Loan Officer salary

Annual: $60,630

Hourly: $29.15

Junior Mortgage Loan Officer salary

Annual: $19,180

Hourly: $9.22

New Hampshire

Loan officer salaries in New Hampshire were found to be 29% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $157,270

Hourly: $75.61

Intermediate Mortgage Loan Officer salary

Annual: $76,430

Hourly: $36.75

Junior Mortgage Loan Officer salary

Annual: $30,780

Hourly: $14.80

New Jersey

Loan officer salaries in New Jersey were found to be 11% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $150,120

Hourly: $72.18

Intermediate Mortgage Loan Officer salary

Annual: $73,180

Hourly: $35.18

Junior Mortgage Loan Officer salary

Annual: $37,880

Hourly: $18.21

New Mexico

Loan officer salaries in New Mexico were found to be 5% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $122,480

Hourly: $58.89

Intermediate Mortgage Loan Officer salary

Annual: $51,460

Hourly: $24.74

Junior Mortgage Loan Officer salary

Annual: $26,820

Hourly: $12.90

New York

Loan officer salaries in New York were found to be 36% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $202,910

Hourly: $97.55

Intermediate Mortgage Loan Officer salary

Annual: $78,520

Hourly: $37.75

Junior Mortgage Loan Officer salary

Annual: $36,360

Hourly: $17.48

North Carolina

Loan officer salaries in North Carolina were found to be 9% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $126,900

Hourly: $61.01

Intermediate Mortgage Loan Officer salary

Annual: $62,360

Hourly: $29.98

Junior Mortgage Loan Officer salary

Annual: $32,550

Hourly: $15.65

North Dakota

Loan officer salaries in North Dakota were found to be 12% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $114,690

Hourly: $55.14

Intermediate Mortgage Loan Officer salary

Annual: $67,610

Hourly: $32.51

Junior Mortgage Loan Officer salary

Annual: $36,900

Hourly: $17.74

Ohio

Loan officer salaries in Ohio were found to be 11% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $122,200

Hourly: $58.75

Intermediate Mortgage Loan Officer salary

Annual: $64,770

Hourly: $31.14

Junior Mortgage Loan Officer salary

Annual: $31,030

Hourly: $14.92

Oklahoma

Loan officer salaries in Oklahoma were found to be 10% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $118,520

Hourly: $56.98

Intermediate Mortgage Loan Officer salary

Annual: $61,230

Hourly: $29.44

Junior Mortgage Loan Officer salary

Annual: $28,700

Hourly: $13.80

Oregon

Loan officer salaries in Oregon were found to be 17% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $126,300

Hourly: $60.72

Intermediate Mortgage Loan Officer salary

Annual: $64,610

Hourly: $31.06

Junior Mortgage Loan Officer salary

Annual: $31,790

Hourly: $15.28

Pennsylvania

Loan officer salaries in Pennsylvania were found to be 14% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $132,143

Hourly: $63.53

Intermediate Mortgage Loan Officer salary

Annual: $66,807

Hourly: $32.12

Junior Mortgage Loan Officer salary

Annual: $33,775

Hourly: $16.24

Rhode Island

Loan officer salaries in Rhode Island were found to be 7% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $117,580

Hourly: $56.53

Intermediate Mortgage Loan Officer salary

Annual: $60,460

Hourly: $29.07

Junior Mortgage Loan Officer salary

Annual: $32,640

Hourly: $15.69

South Carolina

Loan officer salaries in South Carolina were found to be 12% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $121,810

Hourly: $58.56

Intermediate Mortgage Loan Officer salary

Annual: $60,250

Hourly: $28.96

Junior Mortgage Loan Officer salary

Annual: $32,120

Hourly: $15.44

South Dakota

Loan officer salaries in South Dakota were found to be 3% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $91,390

Hourly: $43.94

Intermediate Mortgage Loan Officer salary

Annual: $59,520

Hourly: $28.62

Junior Mortgage Loan Officer salary

Annual: $43,120

Hourly: $20.73

Tennessee

Loan officer salaries in Tennessee were found to be 2% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $114,660

Hourly: $55.13

Intermediate Mortgage Loan Officer salary

Annual: $54,490

Hourly: $26.20

Junior Mortgage Loan Officer salary

Annual: $29,480

Hourly: $14.17

Texas

Loan officer salaries in Texas were found to be 25% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $156,890

Hourly: $75.43

Intermediate Mortgage Loan Officer salary

Annual: $68,710

Hourly: $33.03

Junior Mortgage Loan Officer salary

Annual: $35,430

Hourly: $17.03

Utah

Loan officer salaries in Utah were found to be 7% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $97,870

Hourly: $47.05

Intermediate Mortgage Loan Officer salary

Annual: $45,470

Hourly: $21.86

Junior Mortgage Loan Officer salary

Annual: $27,520

Hourly: $13.23

Vermont

Loan officer salaries in Vermont were found to be 1% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $109,770

Hourly: $52.77

Intermediate Mortgage Loan Officer salary

Annual: $58,650

Hourly: $28.20

Junior Mortgage Loan Officer salary

Annual: $35,090

Hourly: $16.87

Virginia

Loan officer salaries in Virginia were found to be 12% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $142,760

Hourly: $68.63

Intermediate Mortgage Loan Officer salary

Annual: $63,860

Hourly: $30.70

Junior Mortgage Loan Officer salary

Annual: $34,670

Hourly: $16.67

Washington

Loan officer salaries in Washington were found to be 2% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $133,940

Hourly: $64.39

Intermediate Mortgage Loan Officer salary

Annual: $60,540

Hourly: $29.11

Junior Mortgage Loan Officer salary

Annual: $29,880

Hourly: $14.37

West Virginia

Loan officer salaries in West Virginia were found to be 6% lower than the national average.

Senior Mortgage Loan Officer salary

Annual: $93,350

Hourly: $44.88

Intermediate Mortgage Loan Officer salary

Annual: $48,820

Hourly: $23.47

Junior Mortgage Loan Officer salary

Annual: $28,870

Hourly: $13.88

Wisconsin

Loan officer salaries in Wisconsin were found to be 13% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $120,400

Hourly: $57.88

Intermediate Mortgage Loan Officer salary

Annual: $62,850

Hourly: $30.22

Junior Mortgage Loan Officer salary

Annual: $34,750

Hourly: $16.71

Wyoming

Loan officer salaries in Wyoming were found to be 5% higher than the national average.

Senior Mortgage Loan Officer salary

Annual: $110,380

Hourly: $53.07

Intermediate Mortgage Loan Officer salary

Annual: $61,860

Hourly: $29.74

Junior Mortgage Loan Officer salary

Annual: $33,460

Hourly: $16.09

chapter 4:

Best Paid Skills & Qualifications For a Loan Officer

As an MLO, you will be a crucial point of contact with borrowers.

This involves a healthy dose of business and interpersonal skills.

In this chapter we will go over the best paid skills and qualifications that help you make the highest possible income in your career.

Let’s get into it!

Best Paid Skills for a Mortgage Loan Officer

Business Skills

A sound knowledge of the following will take you far in your career as a Mortgage Loan Originator:

- Financial advising

- Sales experience

- FHA loans

- Refinancing agreements

- Real estate

- Residential lending

- Relationship management

- Recruitment practices

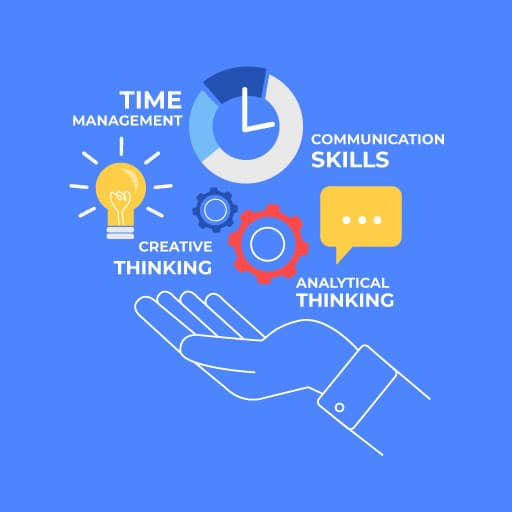

Soft Skills

There are a couple of integral soft skills that will help you excel as a loan officer. These are as follows:

- Analytical and critical thinking

Reviewing tons of paperwork requires a fair bit of pragmatism leaving no room for speculation when it comes to numbers. You must also have the ability to realistically anticipate different parts of the process, say for instance, the reaction to your underwriting request. - Time management

Seeing as you’ll be shuffling between different loan applications, scheduling and prioritizing projects is an absolute must. - Excellent verbal and written communication skills

It’s important to have your clients trust you without question, given that this is such a sensitive process that involves a lot of money. If you’re a good communicator, you will be able to instill confidence in your abilities. - Creative thinking

Creativity plays a huge role in problem-solving; something you will have to do a lot as you collaborate with clients and colleagues.

Best Paid Qualifications for a Mortgage Loan Officer

The minimum education required as per most job descriptions is a high school diploma or GED.

Some descriptions also require an advanced education such as a BA or BS in economics, finance, business, or other related field. Career Explorer found that 7% of loan officers have a degree in finance and 5% in economics.

This data from Indeed was drawn from 20 job openings that specifically highlighted this field of study.

Important: Before you can practice legally as an MLO in any state in the U.S., you must apply for a license through the Nationwide Mortgage Licensing System (NMLS). You will also need to complete 20 hours of NMLS-approved training including any additional state-specific coursework.

If you need a step-by-step guide on how to start, we highly recommend our article, How to Become a Loan Officer (7 Step Guide).

Want to skip ahead and look at the best NMLS-recognized schools near you? You’re in luck!

Here, we’ve compiled a list of the top 3 NMLS approved schools in your state. You’ll find course pricing, student reviews and state specific requirements all in one place.

chapter 5:

Loan Officer Career Outlook

You’re probably thinking about your career prospects as a loan officer in the industry.

Loan officers have a strong potential to grow in the field quickly, especially people who have solid experience in sales, banking and lending.

The Bureau of Labor estimates that 24,200 job openings are created every year. There is projected to be a 3% growth in employment in this field between 2019 to 2029.

Raise.me found that the projected career growth rate is 11% for loan officers which is higher than the 7% average for most other occupations.

Career Growth for a Loan Officer

It’s been seen that most loan officers don’t advance internally within a company all that much.

They may, for instance, get promoted to the role of a senior officer, however, that doesn’t typically mean much aside from a spike in the compensation. Work-wise, you’ll be looking at the same type of day-to-day responsibilities.

Most loan officers eventually make lateral transitions from one institution to another or open their own business.

The switch usually happens because of the draw of a higher commission, great bonuses or a bump in the base salary.

Experience is a huge hook for recruiters. If you are successful in creating and managing a valuable book of business, there is the possibility to switch to a six-figure job within 4 to 8 years of starting your career.

How to Boost Your Salary As a Mortgage Loan Originator

There’s no elusive formula to becoming a high-performing well paid loan officer. It just takes dedication and patience.

Focus on these two crucial things and you should be well on your way to boosting your salary as a Mortgage Loan Officer:

Network, network, network

We know that salesmanship is key as a loan officer. What’s equally important is making authentic connections with the people around you. Don’t shy away from picking up a phone, or visiting realtors to grow your network of peers and clients. Initially, you’ll hit a few brick walls but it will start paying off quicker than you realize!

Build a good book of business

It’s all about the hustle. Work as diligently as you can to close as many loans as possible. Take a genuine interest in understanding each borrower’s profile and needs, that way, you’ll be more prepared to handle all sorts of accounts with ease, and seldom find yourself out of your depth.

Your book will also be very valuable in procuring better job prospects in the future.

Ready to Kick Off a Very Lucrative Career?

There is a lot of opportunity to make a great living as a loan officer and enjoy a long-lived and thriving career.

It’s important to stay the course as you’ll also encounter tons of challenges along the way.

Because you’ll be a part of big life decisions and private family moments, the pay off both monetarily and emotionally is well worth it.

Our final tip is to never lose your passion. Keep researching the industry, reevaluating your career goals and gaining a deeper understanding of the type of institution you want to work for and the compensation structure that you prefer.

You got this.

Leave a comment below and let us know what you think.